Black Triangle Campaign COMMENT:

As the debate rages on, Scotland’s poorest people demand a comprehensive cross-party solution to protect them from the Bedroom Tax NOW and not in some dimly perceived ‘over the rainbow’ world!

We need action NOW!

We believe in Life before Independence!

Playing party politics over this is nothing short of a DISGRACE!

Enough of the mud-slinging:

BLOODY WELL UNITE AND SORT IT OUT!

ALL OF YOU MSP’S!

THE BEDROOM TAX – DIVIDED BY ZERO

This video is for ALL the ‘Hostages’ of the Bedroom Tax.

Stay strong!

Posted on March 28, 2013 by Rev. Stuart Campbell in Wings over Scotland

Newsnight Scotland presenter Gordon Brewer got a bit exasperated on last night’s edition of the show as he tried, repeatedly but unsuccessfully, to get Scottish Labour’s ever-smirking Jackie Baillie to give him anything resembling a straight answer to a question about Labour’s (lack of) policy on the bedroom tax.

Jackie Baillie

As the well-fed welfare spokeswoman embarked on another pre-scripted soundbite of SNP-bashing rather than commit Labour councils to a policy of not evicting tenants for arrears related to the penalty charge, Brewer sighed (at around 12m 52s) that “I was vainly trying to take into consideration the people who might be affected by this” before giving up and moving on to his other guest.

Baillie was demanding that the Scottish Government instead bring forward legislation to make such evictions illegal – just a few days after Scottish Labour’s press office had strenuously denied to this very website that the party was making any such demands. But it’s easy to see why she’d be having trouble keeping track of her position, because to Labour the bedroom tax is little short of a delight.

Now, we don’t seek to cast aspersions on every individual member of the Labour Party when we say that. We’re sure there are some, even many, in the party who are genuinely outraged by the Westminster government’s despicable persecution of the vulnerable in order to fund tax cuts for the rich. But there can be not a scintilla of rational doubt that the Parliamentary party can scarcely contain its glee.

The bedroom tax is Labour policy – Gordon Brown introduced it for private-sector tenants back in 2008, and the only reason the coalition’s extension of it to social tenants is attracting so much more opprobrium is that the government is pursuing it with such a naked ideological hatred of the poor. Labour has even admitted that were it to be elected in 2015 it would NOT repeal the tax, merely tinker at its edges.

But nevertheless, that extension – and more particularly the monstrous savagery with which it’s being implemented – provides Labour with an opportunity to attack both the Tories at Westminster and the SNP at Holyrood while dishonestly pretending to offer an alternative, and that’s just about Labour’s favourite thing in the whole wide world.

Most of those opposed to the tax portray the subjects of it as “victims”, but that’s not really an accurate depiction. What they are is hostages. An excellent piece in this morning’s Herald by Anne Johnstone touches on that reality, noting how:

That fact is central to the coalition’s strategy.

Essentially, councils and housing associations are being made to pay a ransom to Westminster to avoid serious harm being done to their poorest citizens.

That ransom is paid in the form of a sacrifice of services – councils are left with little option other than to divert money from libraries, swimming pools and every other kind of municipal facility and provision to avoid the crippling results of either implementing or not implementing the bedroom tax.

Because it’s unquestionably a Catch 22.

If councils and housing associations DON’T enforce the measures, they’ll be left with a huge cash shortfall in their housing benefit budgets. But if they DO, they’ll have to find money for the stratospheric costs of the eviction process and temporary accommodation for the displaced, because there simply aren’t anywhere near enough smaller properties for people to be moved into.

Most independent assessments – and indeed, basic arithmetic – agree that the bedroom tax will not and cannot “save” any money anywhere along the line, even if it were somehow to miraculously operate exactly in line with its supposed aims.

Theoretically, social tenants will be moved from cheap housing into more expensive private-sector properties (since social landlords don’t build one-bedroom homes), swapping places with the over-crowded tenants currently living there who will then move into the social tenant’s now-vacated larger homes.

The net amount of housing benefit payable will obviously therefore remain exactly the same – because the same two properties will still be occupied by the same people, just the other way round – and there will have been a whole slew of extra costs involved in the bureaucracy of moving two families, likely involving appeals and delays, possibly having to evict one or both of them forcibly through the courts, and so on.

But the insanity of the bedroom tax itself has already been extensively covered elsewhere, so we needn’t go over it all again here. Let’s instead stick to our brief and examine how it’s playing in Scotland. Even poor old Alan Cochrane in the Telegraph could see through Labour’s charade:

For once we agree with the old Tory buffer’s analysis – Nicola Sturgeon was on majestic form in the Holyrood chamber exposing Baillie’s hypocrisy. But we need to look at the situation in a little more depth to understand what’s going on.

The only thing Baillie had which was even on nodding acquaintance with a point was when she observed that the SNP’s policy of having all its councils pledge not to evict anyone over bedroom tax arrears only covered council tenants, not those in housing associations. Yet the petition organised by the Govan Law Centre (a body run by Labour activist Mike Dailly) which calls for Scottish Government legislation to outlaw evictions conspicuously fails to feature any housing associations in the list of organisations supporting it.

This may be because housing associations are terrified at the prospect of thousands of tenants being able to default indefinitely on their rent (either out of malicious opportunism, or desperation at facing a choice between paying the rent or other bills) in the certain knowledge that they won’t be evicted, or of the costs of arrears/evictions forcing the associations to recoup their losses elsewhere, either by cutting services or increasing rents for other tenants who may be barely any better off.

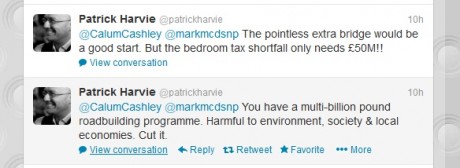

Faced with that fact, other doubtless well-intentioned figures like Patrick Harvie of the Scottish Greens have instead called for the Scottish Government to simply find money from elsewhere in its budget to bridge the gap, citing the relatively small sums involved.

(Said to be somewhere in the area of £55m, though that covers only the amount of the tax itself and not the costs of the bureaucracy required to process requests and payments.)

But such calls fail to understand the first rule of hostage-taking: paying ransoms creates more hostages.

As suggested by Anne Johnstone’s Herald piece, the coalition will be thrilled beyond measure if the Scottish Government and local councils fund its vicious cuts for it.

The outcome would in effect be a large subsidy of the UK Treasury by Scotland, leading to cuts elsewhere for which the Scottish Government and councils (none of which are Tory-controlled) would be blamed – a win/win scenario for David Cameron and George Osborne.

In such an eventuality, why would the UK government stop there?

What else could it cut, secure in the knowledge that Holyrood (having set a precedent) would find itself besieged with demands to mitigate that too?

The easy temptation for anyone with an ounce of human compassion is to say

“Never mind all that politics, people are suffering now and must be helped no matter what”.

But what’s the reality in Scotland?

As we’ve just said, no Scottish councils are Tory-controlled.

While it’s highly likely that evictions for bedroom-tax arrears will actually happen south of the border, the first council to bring one about in Scotland would surely be committing a spectacular act of political suicide, never mind the financial self-harm it would also be inflicting on itself.

Numerous other options are possible and are already being explored to circumvent the tax, such as redesignating bedrooms.

The UK government has no conceivable hope of policing such matters across hundreds of thousands of homes – or indeed the means to do so even if it wanted to, since any “inspections” to see how many “real” bedrooms homes had would fall under the remit of the councils who were doing the circumventing in the first place.

The bottom line is that ONLY councils and housing associations can effectively mitigate against the bedroom tax. Scottish Government legislation would be like trying to fix a crack in a pane of glass using a sledgehammer.

This state of affairs ought to be (quite literally) right up Scottish Labour’s street – as council level is the only place the party still wields political power in Scotland, and it constantly demands that more power be devolved from Holyrood to city chambers – but in the name of scoring points against the SNP it instead refuses to instruct its councils to take action.

(This is because Labour, on either side of the border, is paralysed by both cowardice and hypocrisy. In Scotland it thinks there’s political capital to be made from the bedroom tax at the expense of the SNP, while in England it’s terrified to be seen as “soft on welfare”, leading to a situation where Labour is loudly screaming its opposition to a tax it invented and plans to keep if it wins the next election, and demanding counter-productive action of others even while it refuses to take much more practical and effective steps itself.)

Mitigation, of course, is itself rather missing the point. Measures like refusing to evict tenants only act as a sticking plaster, buying time in the short term.

The only solution to the problem is for Scotland not to be subject to the vicious ideology of the Tories at all, and there is but one way to ensure that.

Scottish Labour must get serious about battling the bedroom tax, its own MSP has warned as £4.5 billion in welfare cuts loom beyond the border Posted on March 26, 2013

Labour refuse to support Dundee SNP Council’s No Eviction Policy or the abolition of the Bedroom Tax Posted on March 27, 2013

Salmond says SNP councils will fight ‘bedroom tax’ BUT No2BedroomTax Campaign responds that ‘it is not enough’ and that the Scottish Govt. must ‘protect all Scots’ Posted on March 23, 2013

Bedroom Tax ~ ‘The Scottish Government must stop playing politics with disabled people’s lives’ ~ Black Triangle Posted on March 7, 2013

5 Responses

Whilst the efforts by GHA to purchase 1 Bed flats to get round the “bedroom tax” are commendable – is it not missing the point that the regulations actually fail to define a “bedroom”. Rumours have suggested a minimum 70 sq ft. (a 7ft by 10ft room – Parker Morris used to require a minimum 6.5 sq m)(Nottingham has already “ruled out rooms under 50 sqft) – but when does a store room count as a bedroom?. I note that Frank Field MP has called on landlords to “brick up the doors to spare bedrooms and, where appropriate, knock down the walls” so that the properties can safely fit the tenants. When does a small box room cease to be a “bedroom” and become a “walk in wardrobe”?

I note that to count as a “habitable room” under Domestic Building Standards (Section 3.14 and 3.16) a “bedroom” has to have ventilation (either natural ventilation of at least 1/30th floor area (used to be 1/20th) or mechanical or trickle ventilation) AND have illumination (a window) of at least 1/15th of the floor area (used to be 1/10th). So minor works affecting the window area or ventilation would technically make such a room “non-habitable” and therefore unable to formally be counted as a habitable “bedroom”. So is it not more cost effective for responsible social landlords to develop a cheap minor works programme to help affected tenants? Perhaps linked to a campaign for better minimum housing quality standards?

Ironically this reflects the historic window tax (introduced 1696, repealed in 1851) where to avoid the tax houses bricked-up their less important window-spaces to avoid or reduce the tax. Hopefully we won’t have to wait 155 years before the “bedroom tax” is kicked out.

“Only free men can negotiate. Prisoners can’t enter into contracts.” Nelson Mandela

Make the break, Scotland. Set us a good example.

The only people “playing politics” on this issue is the sad a sorry Labour Party in Scotland trying to pretend that Labour did not vote against his matter in Parliament. Are you trying to divert us from pointing this out?

you are seen as making yourself intentionally homeless if evicted for non payment of rent so they then refuse to help you if you are made homeless because of it!

I despair I really do!

[…] The UK government has no conceivable hope of policing such matters across hundreds of thousands of h… – or indeed the means to do so even if it wanted to, since any “inspections” to see how many “real” bedrooms homes had would fall under the remit of the councils who were doing the circumventing in the first place. […]