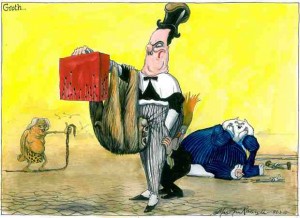

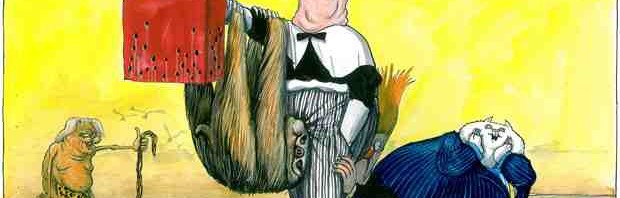

Cartoon by Martin Rowson

“On the fairness front, it pales besides the £10bn of cuts to benefits that Mr Osborne pencilled in for the next parliament to add to the £18bn already planned. Taking such eyewatering sums off the welfare bill is not only worrying – it also sounds implausible.”

Voters got their first real chance to see whose side George Osborne is on.

Two years into his tenure, the chancellor delivered a budget that was not about the big picture of public spending, nor the cratering of the economy.

Wednesday’s red book barely changed the shape of public finances. For each tax giveaway the chancellor awarded, he made one tax or spending takeaway.

In the jargon this is termed a “fiscally neutral” budget – and the politics of making any changes in one of those means that your priorities are immediately exposed. So it was with Mr Osborne’s budget.

He showed just who and what he thinks deserve the biggest handout; and the answer is a dismaying one.

Going by his budget, the chancellor – and by extension the government as a whole – thinks that the super-rich deserve lower taxes while pensioners should hand back more to the Treasury.

He believes business ought to get a helping hand through lower corporation taxes, even while Britain’s army of 2.7 million unemployed got barely a mention. All in it together? It was notable that this formerly much-used phrase was not uttered by the chancellor.

In the majority of cases, the actual sums under discussion are not large – but, as Ed Miliband suggested in his strong parliamentary performance, the signals they send out are terrible. For many in the country, this budget will indicate that the Conservatives within the coalition are reverting to type, eager to help out their friends in the City (who, recent analysis by the Bureau of Investigative Journalism shows, now contribute over half the party’s funds) with an unnecessary tax cut. Certainly, Mr Osborne thought it unnecessary in last November’s mini budget. Four months ago, cutting taxes for the super-rich was not what the chancellor saw as a priority; now it’s among his top priorities. This raises one simple question: why?

Sure enough, the Treasury will point out the mini-mansion tax of a sharp rise in stamp duty on houses worth over £2m, and a raft of anti-avoidance measures. But it is hard to think of a recent chancellor who has not clamped down on devious tax planning – and Mr Osborne’s initiative was no great advance on anything brought out by Alistair Darling.

Meanwhile, middle-aged workers now face the prospect of a much poorer retirement. They face a triple whammy: the over-65 tax allowance will be scrapped by the time they can claim it, compulsory pension saving by their employers is deferred and their state pension age could be increased without limit.

This is quite some tax raid, compounded by another under-discussed phenomenon: the chancellor is also dragging an extra 300,000 basic-rate taxpayers up into the 40% bracket. The repercussions of that will be felt over time, but they might be surprisingly dramatic. The coalition will point to the raising of the threshold for income tax as its big giveaway – and that certainly has the merit of being primary-colours, easy to understand politics. But it helps middle-earners more than the bottom, as the Institute for Fiscal Studies has pointed out. On the fairness front, it pales besides the £10bn of cuts to benefits that Mr Osborne pencilled in for the next parliament to add to the £18bn already planned. Taking such eyewatering sums off the welfare bill is not only worrying – it also sounds implausible.

Ministers have not made things easier for themselves by leaking the budget so thoroughly; it meant that chunks of the chancellor’s speech sounded rather like a review of the past week’s newspapers and primed the opposition and analysts to look for nasty surprises. But that does not excuse an incoherent budget that made supply-side measures to deal with the lack of demand in the economy, that proclaimed tax simplification even while bringing in tax relief for the makers of Grand Theft Auto. Most of all, it does not forgive a budget that was, politically at least, redistributive in just the wrong direction: taking from the poor to give to the rich.

2 Responses

We Need this Millionaires Regime Out of Office together with Redistribution

of Wealth from Rich to Poor

It Ends when we Get the Con Dems Out and a Decent Government into Office