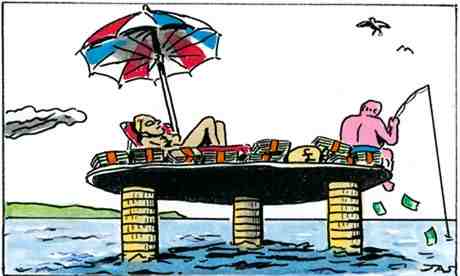

This article should be read with: Super-rich scum stash $21 tn in offshore havens while debts and deadly cuts are shouldered by disabled, ordinary people

Its time to end the Washington Consensus and introduce a fair and progressive system of taxation

Lord Fink, the Tory donor (ennobled 2011) and party treasurer, who succeeded to the post after Peter Cruddas was caught out offering meetings with David Cameron for donations of up to £250,000, has revealed that he asked George Osborne to make Britain more like a tax haven, so we, er, don’t lose jobs to other tax havens, because everyone knows that Guernsey is an economy that dwarfs all others.

What Fink means, I suspect, is that Britain should be more like a tax haven so he doesn’t lose money to anything as morally perverse as a tax system. This is the neoliberal cure for the problem of tax havens, and it makes sense if you love money and hate people. Make everywhere a tax haven. This, in the government’s exhausted social equality jargon, could even be called “fair”.

Not that Osborne agreed with Fink. We know what the chancellor thinks of tax avoidance, because he was moved to comment on it even before the comic Jimmy Carr was exposed as a tax avoider in June and instantly stopped being funny. In his budget speech Osborne denounced “tax evasion and indeed aggressive tax avoidance as morally repugnant”. Morally repugnant? Are you sure? I thought it was welfare recipients, with their pesky need for food and healthcare and jobs (see the whispered philosophising of Mitt Romney) who are morally repugnant; you would certainly think so, from the number of briefings from civil servants hitting the tabloids, moaning about immigrants living in mansions and laughing at the “squeezed middle”.

Other ministers sing the anti-tax avoidance song – Danny Alexander, Vince Cable, even the prime minister, whose private fortune was enhanced by careful investment in tax havens, courtesy of his late father. But while welfare scrounging is morally repugnant enough to act on, tax avoidance, it seems, is not – you can endorse it, and still be Lord Fink (ennobled 2011) and party treasurer. Nothing changes, which makes me wonder if the only person in government telling the truth is Francis Maude who, when accused of trying to turn Britain into a tax haven by a Labour MP 20 years ago, said: “Thank you very much, I appreciate the compliment.” This is an anecdote he tells journalists, so he must think it makes him sound wonderful.

No one is sure quite how much revenue is lost to tax havens and complex avoidance schemes because invisible money is hard to count. You are more likely to see the tax gap wandering down Bond Street than find a note of it in a drawer at HM Revenue and Customs. The Treasury says that almost 14% of the UK tax gap is due to legal tax avoidance. The Times put it at £5bn a year in an investigation this week, with at least £1bn being lost to British citizens living in Monaco, if you can call it living.

Of six Monaco-based donors to – surprise! – the Tory party, one, David Instance, lent Cameron a helicopter in his leadership campaign, so he could fly to meetings and harm the world, like James Bond in reverse. I have seen Monaco; it is all street signs pointing at Prada, billionaires cruising, as if on spring break, and defibrillators at bus stops for when they actually do break. Only a person who thinks paying capital gains tax is the same thing as being beaten up by a gang of social democrats would actually live there, but they do.

In the report The Price of Offshore Revisited, James Henry, formerly the chief economist at McKinsey, puts the amount invested through tax havens between £13 trillion and £20tn, which is more than US and Japanese GDP combined. It enough to write off third world debt, reinstitute Sure Start, even in a property market as inflated as Monaco, and buy the prime minister enough helicopters to fill the skies. He could spell out his name in them.

Action is promised, but always snuffed out. The G20 said it would “close the door on tax havens” in 2009, after taxpayers bailed out banks and bankers – the state does have uses, you see, despite its baffling hunger for tax revenue. The G20 showed the robustness of its determination by flexing its giant fists and, er, requesting more transparency from tax havens, which they were, amazingly, reluctant to provide. And why would they when the people asking for transparency are so often the same people languishing offshore? This week the Guardian reported that 68 peers and MPs work for firms that operate in tax havens.

Meanwhile, the amount held in bank accounts in tax havens was £1.7tn in 2011 – the same as in 2007. With insane hubris, the crackdown, a few treaties and a lot of money moving from tax haven to tax haven, was called a success. What would they consider a failure?

In November, Angel Gurría, general secretary of the Organisation for Economic Co-operation and Development, or, as I am calling it, the Organisation for Talk, Wait and Do Nothing, told the G20: “The era of bank secrecy is over.” The most amusing result was that Jersey was seriously rattled: in June, Sir Philip Bailhache (knighted 1996) the island’s assistant chief minister, threatened to declare independence from the UK. On that, too, we are still waiting.

Twitter: @TanyaGold1

guardian.co.uk © Guardian News & Media Limited 2010

Published via the Guardian News Feed plugin for WordPress.

Thieving, conniving, evil, Nazi, back stabbing, murdering, inhuman, uncaring, Tory Bastards. The people of Britain rests their case your Honour. (feel free to add more insults if you wish)